Quotes from Sampath Sharma Nariyanuri, Senior Fintech Research Analyst at S&P Global Market Intelligence:

“Looking ahead to 2025, there are promising signs of recovery. Expectations of lower interest rates, coupled with recent funding momentum, point to a potential rebound. A pipeline of high-profile fintech IPOs could inject much-needed liquidity into the ecosystem, sparking a renewed cycle of funding activity. As venture capital firms reassess their portfolios, we anticipate a shift toward underserved segments and regions, positioning fintech sectors and geographies that underperformed in 2024 for a comeback.

“North America, particularly the US, is poised for a significant resurgence, while payments could re-emerge as a dominant investment theme. We remain optimistic about startups driving innovation in payment flows, enhancing money movement infrastructure, and delivering value-added services—key areas that are likely to shape the next wave of fintech growth.”

Key highlights from the report include:

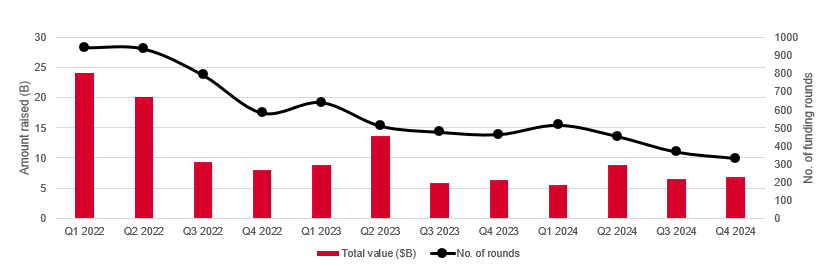

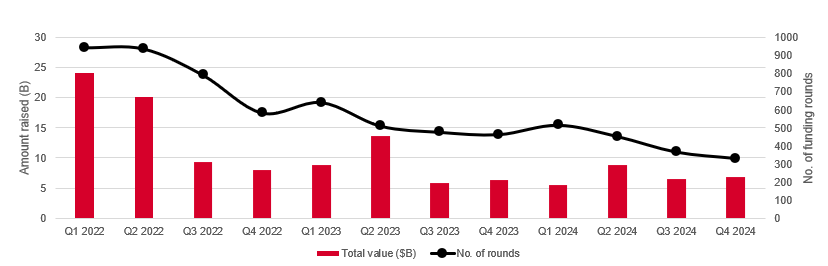

- Financial technology (fintech) startups globally engaged in 1,671 funding rounds worth $28 billion in 2024, according to S&P Global Market Intelligence data. This represents a 20% fall in both round count and dollar value on a year-over-year (y/y) basis. In the fourth quarter of 2024, funding rose 17% y/y to $6.86 billion, even as the number of transactions fell 28% y/y to 333.

- Mega rounds worth at least $100 million picked up slightly in the latter half of the year, with 31 deals, compared to 24 in the first half of 2024. Many of the largest funding rounds are directed toward capital-intensive business models such as digital lending, attracting private equity firms, hedge funds and traditional financial institutions with expertise in credit and banking, rather than venture capitalists from Silicon Valley.

- Among key fintech hubs, funding in the US dropped 40% y/y, falling from $17 billion in 2023 to $10 billion in 2024, with deal counts declining 17% y/y to 615. In contrast, the UK saw funding surge by 46% y/y to $4 billion, despite a 19% y/y drop in deal volume to 160. India’s funding was halved to $1 billion, accompanied by an 8% y/y decline in transactions to 134. Singapore’s funding remained steady at $1 billion, though deals decreased by 16% y/y to 72. Among other notable VC destinations, Brazil was the only market to exceed the $1 billion mark.

- By segment, payments saw a dramatic 50% funding decline to $7 billion y/y, with deals down 23% to 392. Banking technology doubled its funding to $6 billion, despite a 22% y/y drop in transactions to 184. Insurance technology faced a 40% y/y drop in funding to $3 billion, with deal counts falling 39% y/y to 187. Digital lending maintained $6 billion in funding but saw a 27% y/y drop in transactions to 230.

- Seed-stage funding bore the brunt of the downturn, with deal counts plummeting 46% from 1,012 in 2023 to 547 in 2024. Early-stage funding fell 37% during the same period, while growth and mature stages dropped 34% and 26%, respectively.

Quarterly fintech funding count, value trends

Source: S&P Global Market Intelligence 451 Research.

© 2025 S&P Global.

Please attribute any commentary/data you cite from this analysis to S&P Global Market Intelligence.

To speak with Sampath Sharma Nariyanuri or to request more findings from the report, please contact press.mi@spglobal.com.

* This was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.